A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven...

258 KB (26,662 words) - 19:49, 29 March 2024

Corporate haven (redirect from Corporate tax haven)

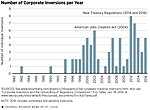

S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received...

213 KB (19,769 words) - 21:31, 9 June 2024

Medtronic (category Tax inversions)

low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block...

54 KB (4,676 words) - 11:26, 24 July 2024

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little...

243 KB (24,923 words) - 00:57, 16 July 2024

Restaurant Brands International (category Tax inversions)

various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians...

17 KB (1,519 words) - 20:43, 2 July 2024

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United...

25 KB (209 words) - 14:39, 26 July 2024

alphabetically, with total tax revenue as a percentage of gross domestic product (GDP) for the listed countries. The tax percentage for each country...

19 KB (98 words) - 03:43, 24 June 2024

types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance...

138 KB (5,422 words) - 13:05, 25 July 2024

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale...

104 KB (13,794 words) - 18:57, 23 July 2024