corporations (MNCs). Corporate tax in the Netherlands deals with the tax payable in the Netherlands on the profits earned by companies. For tax purposes, a company...

23 KB (2,907 words) - 11:27, 11 August 2024

Corporate haven, corporate tax haven, or multinational tax haven is used to describe a jurisdiction that multinational corporations find attractive for...

213 KB (19,769 words) - 21:31, 9 June 2024

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar...

51 KB (5,721 words) - 13:19, 20 August 2024

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as...

62 KB (6,591 words) - 10:00, 4 July 2024

added tax (Wet op de omzetbelasting 1968) and the corporate tax (Wet op de vennootschapsbelasting 1969). In the Netherlands, residents pay income tax on...

13 KB (1,543 words) - 20:22, 13 May 2024

Income tax in the Netherlands (personal, rather than corporate) is regulated by the Wet inkomstenbelasting 2001 (Income Tax Law, 2001). The fiscal year...

17 KB (1,955 words) - 08:52, 14 April 2024

§ Top 10 tax havens include corporate-focused havens like the Netherlands, Singapore, Ireland, and the U.K., while Luxembourg, Hong Kong, the Cayman Islands...

244 KB (24,901 words) - 23:06, 22 August 2024

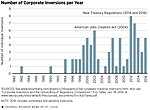

A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

The global minimum corporate tax rate, or simply the global minimum tax (abbreviated GMCT or GMCTR), is a minimum rate of tax on corporate income internationally...

39 KB (4,278 words) - 10:27, 27 April 2024

Dutch Sandwich (redirect from Dutch Sandwich (tax avoidance))

profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring European Union withholding taxes on untaxed profits as...

19 KB (1,853 words) - 22:30, 17 August 2024