A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven...

259 KB (26,756 words) - 01:31, 11 November 2024

Medtronic (category Tax inversions)

low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block...

55 KB (4,721 words) - 04:00, 9 November 2024

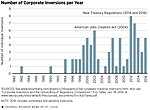

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little...

244 KB (24,898 words) - 14:09, 4 October 2024

Corporate haven (redirect from Corporate tax haven)

S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received...

212 KB (19,738 words) - 22:53, 7 November 2024

Restaurant Brands International (category Tax inversions)

various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians...

18 KB (1,583 words) - 17:25, 29 October 2024

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United...

25 KB (207 words) - 03:28, 25 October 2024

Tariff (redirect from Import tax)

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue...

79 KB (9,411 words) - 15:08, 11 November 2024

types of taxes: corporate tax, individual income tax, and sales tax, including VAT and GST and capital gains tax, but does not list wealth tax or inheritance...

138 KB (5,447 words) - 18:05, 5 November 2024

law would reduce the incentive for tax inversion, which is used today to obtain the benefits of a territorial tax system by moving U.S. corporate headquarters...

174 KB (16,845 words) - 17:50, 8 November 2024