A tax inversion or corporate tax inversion is a form of tax avoidance where a corporation restructures so that the current parent is replaced by a foreign...

92 KB (9,812 words) - 21:45, 1 January 2024

tax inversions in history, and Apple was over one–fifth of Irish GDP. Academics rank Ireland as the largest tax haven; larger than the Caribbean tax haven...

259 KB (26,756 words) - 02:34, 21 September 2024

Medtronic (category Tax inversions)

low corporation tax regime. Medtronic's tax inversion is the largest tax inversion in history, and given the changes in the U.S. tax-code in 2016 to block...

54 KB (4,696 words) - 03:57, 16 September 2024

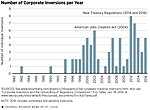

legal headquarters from a higher-tax home jurisdiction to a tax haven by executing a tax inversion. A "naked tax inversion" is where the corporate had little...

244 KB (24,898 words) - 14:09, 4 October 2024

Corporate haven (redirect from Corporate tax haven)

S. corporates execute tax inversions (see § Bloomberg Corporate tax inversions). Since the first U.S. corporate tax inversion in 1982, Ireland has received...

212 KB (19,738 words) - 17:47, 13 September 2024

Restaurant Brands International (category Tax inversions)

various sheltering techniques to reduce its tax rate to 27.5%. As a high-profile instance of tax inversion, news of the merger was criticized by U.S. politicians...

18 KB (1,583 words) - 23:06, 12 September 2024

Mallinckrodt (category Tax inversions)

headquartered in Ireland for tax purposes, its operational headquarters are in the U.S. Mallinckrodt's 2013 tax inversion to Ireland drew controversy when...

50 KB (5,094 words) - 22:00, 12 September 2024

of companies includes only publicly traded companies, also including tax inversion companies. There are also corporations having foundation in the United...

25 KB (207 words) - 03:16, 24 September 2024

Allergan (category Tax inversions)

Allergan plc was created from the 2015 merger and Irish corporate tax inversion of two companies, Irish-based Actavis plc and U.S.-based Allergan, Inc...

37 KB (2,790 words) - 22:15, 14 August 2024

Perrigo (category Tax inversions)

Ireland for tax purposes, which accounts for 0.60% of net sales. In 2013, Perrigo completed the sixth-largest US corporate tax inversion in history when...

28 KB (2,548 words) - 04:30, 13 August 2024